| For the few who may not be familiar with his name, Carlos Brito is the big cheese at Anheuser-Busch Inbev, the world's largest brewer. Brazilian by birth with a Stanford graduate degree, he's a finance guy who ran Belgium's Inbev, the brewer of Stella Artois, before the A-B takeover. |

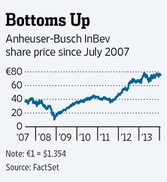

Brito is legendary for leading extremely profitable operations, and so has been a Wall Street favorite. He acquires companies and runs them much more efficiently than the previous owners. To grow, he acquires other breweries, or simply expands brands into new geography. He has no corporate jet, no private office, no high-roller hotel suites on the road. All of those, and a good deal more, had long been part of the Anheuser-Busch culture.

A-B's underlying business challenge

The share declines for A-B's biggest brands (some dating back well before Brito's arrival) continue pretty much unabated. The lost volume is staggering, and almost certainly exceeds any pre-takeover projections. Well over two million barrels on just Budweiser and Bud Light lost since 2008. And a number of high-profile new product launches, including Budweiser Black Crown, Bud Light Platinum, and most recently, Lime-a-Rita, are tanking. You can be the most cost-conscious and efficiency-minded businessman out there, but if top-line revenue is trending the wrong way like this, you will not be a hero in the long run.

One analyst recently expressed his view as to Brito's immediate challenge. It's a double-whammy, quoting Beer Marketers Insights: "To stabilize market share, A-B not only has to grab 'disproportionate share' of high-end growth, but 'work to stem the recent declines in the premium light category.'"

Simply put, A-B has to sell more beer. A lot more beer. (Hard to believe analysts get the big bucks for reaching conclusions this obvious, eh?) Selling more beer means A-B's marketing has to become dramatically more effective. And fast.

I really hope I'm wrong, but without a fundamental change in Brito's philosophy, I am pessimistic about the prospects for pulling this off.

A philosophy problem

In a presentation to Stanford's business-school students, Brito emphasized his key point: "People are the only sustainable advantage a company can have over competition." He went on to make this remarkable statement: "(We) tend to get distracted that what counts is really the brands, the factories, the warehouses, the trucks, the access to market, and forget the people component.”

While few would argue against people being key to making a company great, there's a very troubling assumption in that second statement.

Brito is not the first finance guy to equate brands with other company assets like trucks and warehouses, and fail to appreciate the profound difference. In the world of finance, everything can be measured, and reduced to a straightforward cost-return equation. But unlike inanimate vehicles and buildings, brands are living assets. As proof of this distinction, brands do not appear on the finance guy's holiest of documents, the balance sheet. They share this distinction with the company's other living assets, its people.

My advice

Treasure those brands, Mr. Brito. Every bit as much as you treasure your star-performer people. Perhaps more. They alone can drive the U.S. revenue growth you need. And with good stewardship, the brands will outlive us all.

Understand the brands in great detail. Not in binders full of facts, but in your heart. Study their histories, their idiosyncracies. Know the exact character of their bond with customers. Know particularly why so many people remain so loyal to them. And above all, find new ideas consistent with the brand that can strengthen that bond, and expand it to new customers. In the process, do not fall for the marketing mysticism that promises brand popularity through flashy ads. Those ads do not sell beer. Fire the charlatans who tell you otherwise.

The power of the brands lies in the business they can produce now, and long into the future.

Sustain that advantage, Carlos.

RSS Feed

RSS Feed