Last week, a Beer Business Daily article proclaimed "It's make or break for Bud Light." By way of on an interview with the brand's top marketer, the editor and publisher of the highly respected industry newsletter uncovered insight into what lies ahead in the ads for America's #1 beer.

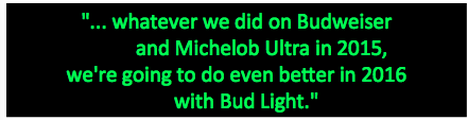

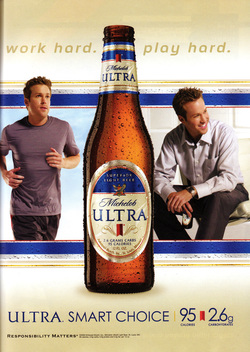

But lest we get too optimistic that the same proven-successful focus is coming soon on Bud Light...

Elsewhere in the interview...

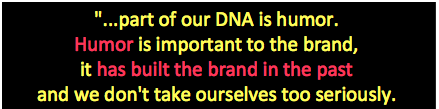

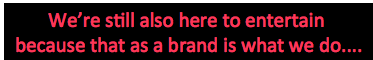

And while we're wondering about humor building any brand, here comes a peculiar misunderstanding of the fundamental purpose of advertising, from the mouth of the guy who's charged with deciding how to spend Bud Light's advertising millions...

But there's no way Bud Light would fall for that... again.

Is there?

RSS Feed

RSS Feed